nh property tax rates per town

New Hampshire has one of the highest average property tax rates in the country with only two states levying higher property taxes. Total rate per 1000 property value NH Property Tax Rates by Town 2018 City or Town Tax on a 278000 house see note 1015 948 445 208 2616 1176 403 161 215 1955 1730 582 308 219 2839 1439 1097 201 235 2972 1916 607 305 229 3057 2071 291 356 207 2925 352 652 192 220 1416 1701 1043 181 217 3142.

Mark Fernald Why Your Property Taxes Are So High

The 2021 real estate tax rate for the Town of Stratham NH is 1852 per 1000 of your propertys assessed value.

. The 2020 equalization rate was set at 961. Tax Incentives and Discounts. 240 rows In New Hampshire the real estate tax levied on a property is calculated by multiplying the.

90 rows 2021 NH Property Tax Rates 15 15 to 25 25 to 30 30 Click or touch any marker on the map. This calendar reflects the process and dates for a property tax levy for one tax year in chronological order. However the states overall tax burden is relatively low.

Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2019 Municipality Date Valuation w Utils Total Commitment 267834140 608 372 184 1299 2463 34216005 482 340 182 412 1416 294970053 460 307 245 1709 2721. New Hampshires lack of a broad-based tax system has resulted in the states local jurisdictions having the 8th-highest property taxes as of a 2019 ranking by the Tax Foundation. Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration Department is intended for informational purposes only.

Total rate per 1000 property value NH Property Tax Rates by Town 2018 City or Town Tax on a 278000 house see note 1015 948 445 208 2616 1176 403 161 215 1955 1730 582 308 219 2839 1439 1097 201 235 2972 1916 607 305 229 3057 2071 291 356 207 2925 352 652 192 220 1416 1701 1043 181 217 3142. Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as property tax per year. Main Level of Town Hall 12 School Street Hudson NH 03051 Phone.

The 2021 tax rate is 1503 per thousand dollars of valuation. If you have any questions please do not hesitate to call the Tax Collectors Office at 603 744-3354. Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2021 Municipality Date Valuation w Utils Total Commitment 272744130 622 327 177 1216 2342 34696705 449 365 183 610 1607 373333529 405 253 194 1489 2341.

In 2010 New Hampshire ranked 8th-lowest among states in combined average state and local tax burden. 236 rows North Hampton NH. Due to the length of time for a complete process of one tax levy dates of multiple tax years will overlap.

Tax Rate Information and History. What is Hampton NH known for. 15 15 to 25 25 to 30 30 tap or click any marker for more information.

The 2019 tax rate is 1486 per thousand dollars of valuation. Values Determined as of April 1st each year. Property Tax Year is April 1 to March 31.

The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000. New Hampshire Property Tax Rates. State Education Property Tax Warrant.

Total Rate New Hampshire Department of Revenue Administration Completed Public Tax Rates 2020 Municipality Date Valuation w Utils Total Commitment 9049351 498 494 193 189 000 422220440 586 166 200 1475 2427 340284288 751 196 202 2291 3440. 603 598-6481 Office Hours Monday - Friday 800am - 430pm. What is the property tax in Portsmouth NH.

The 2020 Tax Rate is 2165 per 1000 Valuation. The 2020 tax rate is 1470 per thousand dollars of valuation. The Property Tax process of assessment collection tax liens deeding interest rates and additional fees are controlled by NH.

Valuation Municipal County State Ed. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title. The assessed value multiplied by the tax rate equals the annual real estate tax.

The 2018 tax rate is 1584 per thousand dollars of valuation. Valuation Municipal County State Ed. Town of Bristol NH 5 School Street Bristol New Hampshire 03222 Tel.

Although the Department makes every effort to ensure the accuracy of data and information. Ad Find Out the Market Value of Any Property and Past Sale Prices. If you would like an estimate of what the property taxes will be please enter your property assessment in the field below.

Valuation Municipal County State Ed.

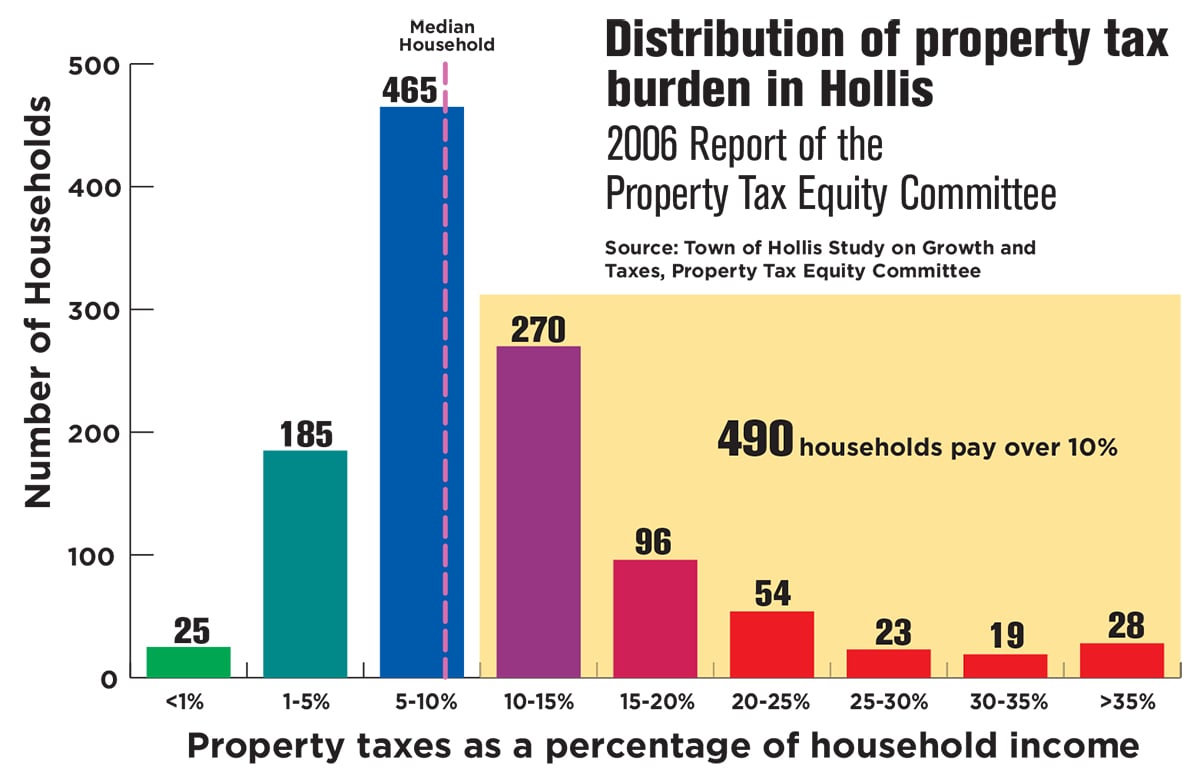

Nh Has A Revenue Problem The Property Tax Nh Business Review

Mark Fernald Why Your Property Taxes Are So High

Does New Hampshire Love The Property Tax Nh Business Review

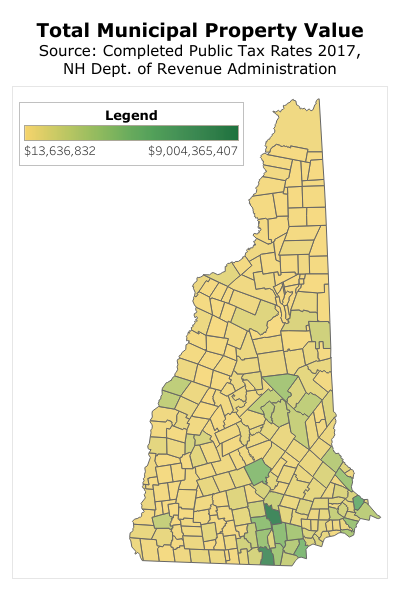

Measuring New Hampshire S Municipalities Economic Disparities And Fiscal Disparities New Hampshire Fiscal Policy Institute

Are There Any States With No Property Tax In 2020 Free Investor Guide Property Tax Indiana State States

The Nh Lecco Pontevecchio Hotel Is In Lecco A Beautiful City By The River Adda A

Property Tax Information Town Of Exeter New Hampshire Official Website

Understanding New Hampshire Taxes Free State Project

Nh Where Rich Towns Like Rye Get Richer And Poor Ones Like Berlin Need Help Indepthnh Orgindepthnh Org